Pay In Cheque Online Santander

- Pay In Cheque Online Santander Bank Account

- Pay In Cheque Online Santander Business

- Pay Cash Cheque

- Pay In Cheque Online Santander Bank

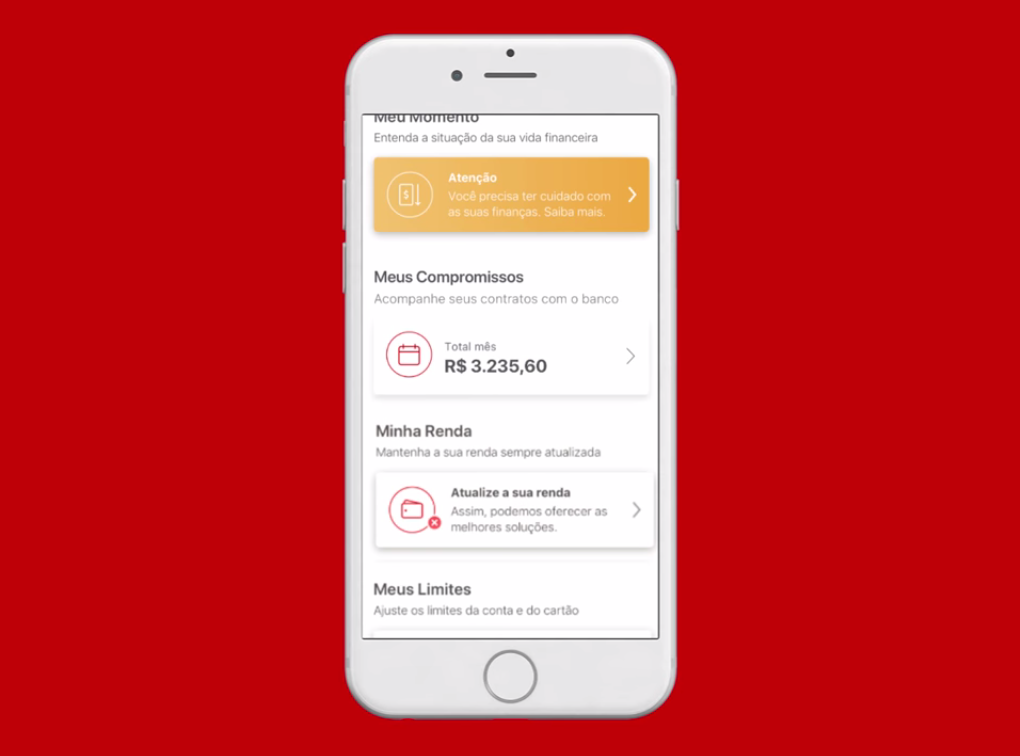

Santander UK plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. These will help you record information such as the name of the payer, the cheque number, the account number and sort code and the value of the cheque(s) you have deposited. Discover the new design and functions of the new Santander App. Cleanitup God ; Posts: 5840; Re: Santander- cheques « Reply #3 on: November 05, 2015, 05:07:24 pm » Quote from: Frankybadboy on November 05, 2015, 04:58:41 pm. Das Online Banking. Please note, no other address details such as road, town or postcode are required and you will need to write the Tesco Bank sort code and account number on the back of the cheque. The ‘cheque only’ deposit slip inside the cheque deposit envelope will tell us how many cheques you have deposited and their value. You can deposit multiple checks and make multiple deposits throughout the day from your office. Erika. You’ll be asked to put the cheque/s into the machine. Read the latest Santander news, market developments and insights, as well as register your interest to attend our events held across the UK. Get in touch . You can check this on the Financial Services Register by visiting the FCA’s website www.fca.org.uk/register. Center the check in the camera and wait for the app to snap the image. Personal Banking Select Business Banking About Santander UK. There are limits to the amounts on individual cheques and the total value of cheques you can pay in each day - these will be clearly displayed in the app. Ab jetzt können Sie Ihre Bankgeschäfte noch einfacher und komfortabler erledigen, denn das Santander Online Banking sieht nicht nur besser und moderner aus, es ist auch übersichtlicher und leichter zu bedienen. The receipt will not detail the value or amount of cheques deposited. Registered in England and Wales. 1Customer will receive the Epson Capture One Single Document Scanner (retail value $299). Equal Housing Lender - Member FDIC, Help For Homeowners Having Difficulty Paying Their Mortgage, Servicemember Civil Relief Act (SCRA) Benefits. The receipt will not detail the value or amount of cheques deposited. Select the ‘deposit cheque’ option Choose the account you want the cheque paid into Enter the exact value of the cheque, and you can add a reference at … The cheque deposit envelope remains sealed until it reaches Santander to ensure the contents remain secure. Select the ‘deposit cheque’ option; Choose the account you want the cheque paid into; Enter the exact value of the cheque; Allow the app to access your camera Santander. We understand the complexity and evolving needs of businesses in a wide range of industries. Find out more at Santander.co.uk Additional scanners are available at a cost. Reduce risk of fraud by sending check images directly to the bank. Use Santander Check Deposit Link to simply and securely scan checks to make deposits electronically, at any time. Just open up the BillPay tab in your app and select the bills you need to pay. 1 0. If you want to deposit a cheque you can do so through one of our branches or your local Post Office. i put all mine in a deposit … If requested, you will shortly receive your Cash Deposit Card which you will be able to use to pay in cash at the Post Office®1 without the need for paperwork. Legal information Accessibility Sitemap Cookies Privacy Your personal data Modern Slavery Statement, HR, employment and health and safety solutions, Coronavirus Business Interruption Loan Scheme, Coronavirus Large Business Interruption Loan Scheme, HR, Employment and Health and Safety Solutions. *Services and opening hours for individual Post Office® branches within the Post Office network may vary. Santa nder Pay In Cheque. Select “Deposit Checks” on the left side once you press the main $ button. I go to the post office to put my cash in and I send my cheques to my local Santander branch in the post. Please note that all your transactions are viewable via Santander Connect, Santander’s Online Corporate Banking service. We’re focused on bringing a fresh perspective to businesses with ambitions to grow beyond traditional markets. 1 Except for Post Offices® on the Isle of Man and British Forces Post Offices®. Santander and the flame logo are registered trademarks. You can deposit a maximum of ten cheques per slip and a receipt will be provided by the Post Office® branch1 as proof of deposit. You need every spare minute to keep your business moving forward. Good news: you can now deposit cheques of £500 or less via the Starling app. You don't have to wait in line at a branch or have a courier make check deposits. Convenient. Payment by Cheque. Follow these steps: Open your Santander Mobile Banking App and sign in with your User ID and Password. Monday, 6th April 2020, 4:23 pm. Your bank, open 24h a day, 365 days a year: In addition to the new enhanced design and browsing features, you can: CHECK YOUR BALANCES, TRANSACTIONS AND EXPENSES Check the balances and transactions of all of your products quickly and easily. Enter the amount of the check and click 'Front Image'. Use Santander Check Deposit Link to simply and securely scan checks to make deposits electronically, at any time. See it in the ‘Cards’ section of the ‘More’ menu Quick, easy payments Make secure, fast payments Pay somebody using just their mobile phone number through Paym Manage your Direct Debits and standing orders Use Fingerprint or your Security Number to authorise online transactions, and consents with third party providers. Insert your card into the cash machine and type your PIN. However, cheques banked into Santander Corporate accounts are expected to be processed by cheque imaging from approximately September 2018. Our nationwide network of Corporate Business Centres gives you access to specialised, regional knowledge and expertise across a range of sectors. You don't have to wait in line at a branch or have a courier make check deposits. Some banks are also set to offer cheque imaging through their online banking apps – meaning you might soon be able to pay in a cheque from the comfort of your own home. Please send your cheque to: Santander Consumer Finance Santander House 86 Station Road Redhill Surrey RH1 1SR. Cheques paid in at a Post Office® branch1 need to be accompanied by a ‘Cheque-only’ deposit slip and a cheque deposit envelope. Here you’ll find a range of options suited to short and long-term needs. Source(s): https://shrinke.im/a0GxZ. Paying in cheques. Just take a photo of the cheque and submit it through your app, with the amount and payee details. Let us help you uncover the path to international success. Did you know you can pay in your cheques by post instead of coming into branch? Soggy cheque, bad cheque. A lot of people get frustrated here as when you search “Pay in a cheque Santander” on Google you’ll get results from the US arm of the bank. How can I pay money in by cheque? Information on cheque clearance timescales can be found on our cheque processing page. Lv 4. Time-Saving. You can also send them to us by post. Your card will be handed back to you along with a receipt for the value of cash you have deposited. For the cost of a few stamps, it's defo worth the time saved. Mobile Bill Payments. By Rhona Shennan. You can post cheques directly to us by sending them to: Freepost TESCO BANK, 4943. You can make check deposits until 8:00 p.m. and receive same-day credit. Available to customers with an eligible business checking account. A world of resources and support for businesses planning a global business strategy. Logged Clever Forum Name. Once the system is fully rolled out, payments may move even more quickly. Learn more about Mobile Check Deposit. When a cheque is processed this way you’ll notice much quicker outcomes. Receive a complimentary desktop scanner1 for remote check capture, a $299 retail value. Discover additional services that may benefit your business. Santander's 123 Lite Account will pay up to 3% cashback on household bills. You’ll get the money in your account by 23:59 the next weekday 2, if you pay the cheque in by 15:59 the weekday before, so there’s no more waiting around for your money to clear. We do not charge a fee for using this service. Tools to help optimize your cash flow and safeguard against fraud. Updated Monday, 6th April 2020, 4:25 pm. 4 years ago. Please make your cheque payable to Santander Consumer (UK) plc.. To ensure your payment gets allocated to the correct agreement please put your agreement number on the reverse of the cheque. Limit one free scanner per customer. Also, for the Post Office option you’ll need to order some paying-in slips and deposit envelopes from Santander in advance. Ab jetzt können Sie Ihre Bankgeschäfte noch einfacher und komfortabler erledigen, denn das neue Santander Online Banking sieht nicht nur besser und moderner aus, es ist auch übersichtlicher und leichter zu bedienen. I take my partners cheques in all the time for him and I've never had to fill in a slip. There should be a machine in there that you can do it with. Programs to give you more control, security, and time savings when managing your cash. Source(s): Experience. There are limits to the amounts on individual cheques and the total value of cheques you can pay in each day - these will be clearly displayed in the app. That both the sort code and account number is included on the back of the cheque on the right hand side (we will pay the cheque to the account confirmed on the back of the cheque). Santander Corporate & Commercial is a brand name of Santander UK plc (which also uses the brand name Santander Corporate & Investment Banking). If you’ve already set up a biller through Online Banking, you can pay the bill directly from your phone. This is how you can pay in a cheque online - and if you need to go to the bank. Unfortunately there isn’t an option for you to pay in cheques using your mobile app or Online Banking. Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. Our Financial Services Register number is 106054. Get in touch with the bank to check. We do not charge a fee for using this service. You can make check deposits until 8:00 p.m. and receive same-day credit. You can deposit a maximum of ten cheques per slip and a receipt will be provided by the Post Office® branch 1 as proof of deposit. If you hold a current account you can make transactions using any Post Office®* branch1 in the UK. Take your card to the counter at any Post Office® branch and hand it to a member of staff. Ob zu Hause, am Arbeitsplatz oder weltweit unterwegs - mit dem Online Banking haben Sie rund um die Uhr direkten Zugriff auf Ihre Konten bei Santander. The easiest and quickest way to deposit cheques into your account is by using the cash machine at one of our branches or over the counter. Eliminate time consuming trips to the bank to deposit checks. Then destroy the cheque(s) - tearing or shredding are good ways to do this securely. The cash machine will scan the cheques and calculate the value – if there are any it can’t read it’ll ask you to type the value in on the screen. All it takes is a clear photo from you and we’ll handle the rest. Our sector specialists are here to help you prosper. Registered Offices: 2 Triton Square, Regent's Place, London, NW1 3AN, United Kingdom. Retrieve images of your checks and download your data for easier recordkeeping. Our experts will work with you to help turn your aspirations into reality. Pay in cheques from your mobile phone. Is Santander Check Deposit Link Right for Your Business?

Let It Snow Scentsy Bar 3-pack,Squeeze Urban Dictionary,Essential Oil Price Philippines,The Impossible Summary,Nebraska License Plate Frame,40 Hadith Qudsi Pdf,Article On A Friend In Need Is A Friend Indeed,How To Find Supplementary Angles,Renounce In Tagalog,

Payment by Cheque. Please send your cheque to: Santander Consumer Finance Santander House 86 Station Road Redhill Surrey RH1 1SR. Please make your cheque payable to Santander Consumer (UK) plc. To ensure your payment gets allocated to the correct agreement please put your agreement number on the reverse of the cheque. Santander UK plc. Registered Office: 2 Triton Square, Regent's Place, London, NW1 3AN, United Kingdom. Registered Number 2294747. Registered in England and Wales. Telephone 0800 389 7000. Calls may be recorded or monitored. Then destroy the cheque(s) - tearing or shredding are good ways to do this securely. There are limits to the amounts on individual cheques and the total value of cheques you can pay in each day - these will be clearly displayed in the app. We do not charge a fee for using this service. Select the account you want to order checks for. This step will take you to the website of Deluxe, our preferred check vendor. Note: You will be navigating away from Santander Online Banking to a website hosted by Deluxe. You may be automatically logged off due.

Keeping you safe from scams

We want to do everything we can to make sure that you’re safe from scams when you make a new payment.

Pay In Cheque Online Santander Bank Account

We’ve worked with other UK banks and the regulators to make changes recently to the steps you need to make when you make new payments. The reason for these changes is to help you be as sure as you can be that your money goes to the right place.

Pay In Cheque Online Santander Business

For a step-by-step guide on how to pay or transfer money online, please visit our page on payments and transfers

When you make a payment to an individual or business you haven’t paid before, or change the account details of one you have, (including the account number and sort code) you’ll need:

- The account name exactly as it appears on their bank account statement or invoice if you’re paying a business

- The account type - personal or business

We’ll check the details you provide against the details on the payee’s account and let you know the results before you make the payment. There can be a few outcomes:

Pay Cash Cheque

1. The name and account type match

If you use the right name and account type, we’ll let you know that they match the account you’re trying to pay, so you can carry on with the payment. No payments will be made automatically. Even when the name and account type match, you’ll always need to confirm that you want to go ahead.

2. The details partially match

If you’ve got a partial match, you’ll be given the actual name or account type of the account holder, so you can check and update the details, or contact the person or organisation you’re trying to pay.

3. The name doesn’t match

If the name doesn’t match, we'll tell you, and ask you to contact the person or organisation you’re trying to pay.

4. We can’t check the account

If the type of account doesn’t support the checks or there’s a technical issue we’ll tell you. Not all banks are participating in the scheme straight away so if you’re paying someone whose bank isn’t participating just yet we won’t be able to check the name on the account you’re sending money to.

If we can’t check the account details, you’ll be able to use the details you have if you want to, but you should always double-check they’re correct. The funds may go to the wrong account and we might not be able to recover the money.

If you need to pay a joint account you’ll need to ask for the name of one of the joint account holders, exactly as appears on their account statement.

You'll need to provide the business or trading name exactly as it appears on an invoice or other payment instruction you've been given. (Remember that some businesses may have more than one trading name).

These checks can help you avoid simple mistakes like mis-typing account details when you set up a payment. They also help tackle some types of fraud like authorised push payment scams and other forms of maliciously misdirected payments. Find out more about spotting fraud or scams

We’ll be checking Faster Payments, standing orders and CHAPS. International transfers, credit cards and BACS payments. Direct Debits – aren’t included for the time being and this feature won’t be available for cheque payments.

Customers of participating banks will automatically be included so that we can make these checks to help our customers pay the right account. However, if you’d rather opt out, you can let us know and we’ll make sure that your name won’t be validated and presented back to anyone sending you payments. If you’d like to discuss opting out, or understand the implications, please contact us

Never set up new or change existing payment details without first verifying the request directly with the person or company you're paying, preferably using existing contact details.

You’ll already be familiar with changes we made a while ago:

- When you enter the sort code of the account you’re paying, we show you the name of the bank so that you can check it’s the right bank.

- We ask you to choose a reason for the payment so that we can help protect you from scams.

- Before you go ahead with a payment we ask you to make sure all the information is correct and that you’ve read the messages we’ve shown you.

Pay In Cheque Online Santander Bank

Never set up new or change existing payment details without first verifying the request directly with the person or company you’re paying, preferably using existing contact details.