Chime Deposit

Banking is done using the Chime Bank’s mobile app. There are absolutely no fees associated with the account, which means all of your money is available for important things like paying bills. You don’t even need an opening deposit or adhere to a minimum account balance. You can deposit cash in your Chime Spending Account at over 90,000 retail locations (like Walmart, Walgreens, and 7-Eleven) with our cash deposit partners. Ask the cashier to make a deposit directly to your Chime Spending Account. You can make up to 3 deposits every 24 hours. Chime is legit, the sh.;-D if you have direct deposit, you have the option to enroll in their 'SpotMe' program. It will cover up to $100, and then you pay it back. I never qualified for more than $20, but even.

And we’ll send you a notification as soon as it hits your Chime account! 2021-02-19 18:22:00. @Chime @mikomi2556 Chime uses a third party provider called Plaid in order to facilitate external account.

Are you familiar with mobile check deposits?

This means you can deposit checks without going to the bank. And, being able to deposit paper checks, such as a stimulus check, without going to the bank can make things super convenient.

Wondering how to deposit a check this way? If you’ve never used mobile check deposit before, it’s not as difficult as you might think. Take a look at 5 tips that can help you make the most of this feature – saving you valuable time.

1. Check your bank’s mobile check deposit guidelines

The first thing you need to do is make sure the organization you’re banking with is set up for mobile check deposits. The easiest way to do that is to check your mobile banking app.

When you log into mobile banking, head to the menu and look for the mobile check deposit option. If you see it listed, then your app should allow you to deposit checks online.

Before you try to use mobile check deposit, however, make sure your account is enabled to do so. While the feature may be available in mobile banking, you may still have to register first or sign up.

2. Review mobile check deposit limits

If you know that you’re able to deposit a check through mobile banking, the next step is to determine whether there are any limits on deposits.

For example, some financial institutions impose limits on the number of checks you can deposit per day or per week. There may also be daily, weekly or monthly limits on the total dollar amount you can add to your bank account using mobile check deposit.

So, make sure you can deposit your check without going over those limits. For example, say you’re married with two kids and you received a federal stimulus check for $3,400. If your bank’s mobile check deposit limit is $5,000 per day, you should be able to deposit the entire check online.

You can usually find out about limits if you read your bank account’s terms and conditions. You can also check your online banking website and look for a section on frequently asked questions. Sometimes this is a good place to start.

What if your check is outside mobile check deposit limits? In this case, you’ll need to find a work-around for depositing it into your bank account. With online bank accounts, for instance, you may have to deposit the money to a checking account at a brick-and-mortar bank, and then move it into your other account via an ACH transfer.

3. Get your check ready for deposit

Chime Card Info

Depositing a check online isn’t exactly the same as depositing it at a branch or ATM. But you still have to sign the back of the check for the deposit to be valid. You also should make sure all the information on the front of the check is correct.

Depending on your bank account, you may also have to write something extra on the back to denote that it’s a mobile deposit. For example, you may have to add “for mobile deposit” or “for remote deposit capture” below your signature.

Also, make sure the check is legible. Your mobile device needs to be able to “read” the check via the camera when you’re ready to deposit it.

4. Deposit your check via mobile banking

Now you’re ready to deposit a check online!

The process can be different depending on your particular bank account. But generally, here’s what you need to do:

- Log into your mobile banking app

- Find the mobile check deposit option in the menu

- Select the account you want to deposit the check into (i.e. checking or savings)

- Enter the check amount

- Snap a photo of the check – front and back. It’s important to make sure you get a clear image of both sides of the check. Otherwise, you may have trouble completing a mobile check deposit. If the images come out fuzzy or blurry, clean off your camera lens. And, make sure you take photos in an area with good lighting so your camera can pick up details on your check.

- Once your device records the images of your check, review the deposit details. Make sure that you’ve signed the check, selected the right account, and entered the correct amount.

5. Wait for the check to clear

If you deposit a stimulus check – or any check – online, you may want to use the money right away. But, you’ll need to wait for the check to clear in your bank account first.

You may now wonder how long it takes for mobile check deposits to clear. Well, this depends on your bank account, the amount of check, and the type of check involved. Again, check your bank account terms and conditions or read through the FAQs. This might offer up some clarity on how long your mobile check deposit will take to be fully credited to your account.

In the meantime, don’t throw the check away. Why? Because there may be a hiccup with your mobile check deposit. If you don’t see the deposit in your account within a week, you may need to call your financial institution to find out what’s happening. You may also need to try making the deposit again.

Once your mobile check deposit clears your bank account, you can then write ‘void’ on the check and file it away.

How to deposit IRS checks with Mobile Check Deposit using Chime

If you are a Chime member and received a government stimulus payment as a paper check, you can deposit it safely and securely at Chime. We take our members’ money seriously, so for these checks, we’re putting extra security measures in place. Here’s how to deposit your IRS checks using our Mobile Check Deposit feature.

1.Make sure the name on the check matches your Chime Spending Account

2. For joint stimulus checks, make sure at least one filer’s name matches the name associated with the Chime Account. Unfortunately, we can’t accept checks that don’t have your name on it

3. Sign the back of your paper check, then write “For deposit to Chime only” under your signature.

For joint stimulus check make sure both of your signatures appear on the back of the check.

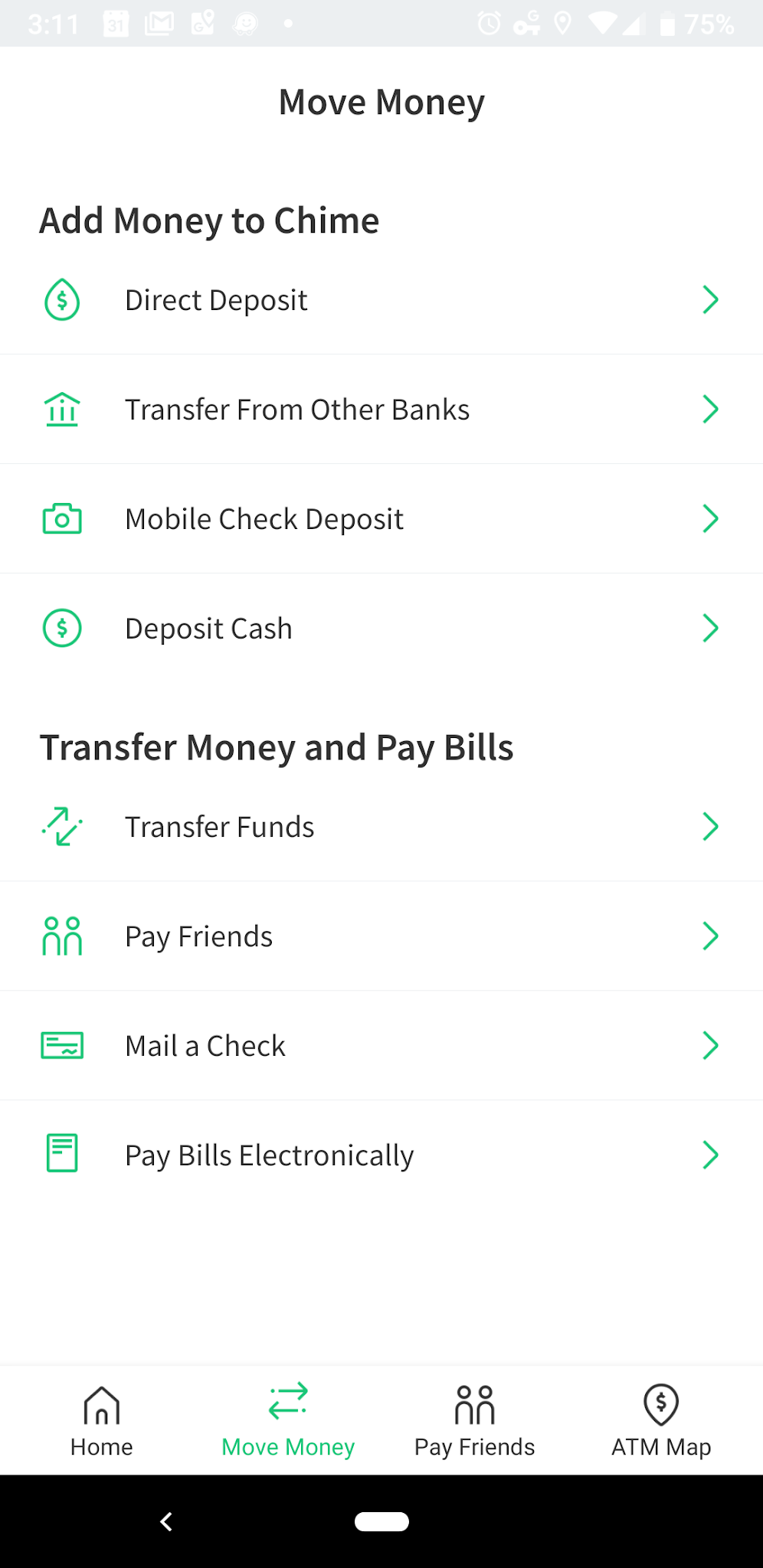

4. Open the Chime app, tap Move Money at the bottom of your screen, then tap Mobile Check Deposit, then U.S. Treasury.

Keep in mind: Mobile Check Deposit for stimulus checks is only available to members that actively use their Chime Spending Account and Chime Visa® Debit Card

5. The Chime app will guide you through the check deposit process – it’s easy!

Are you using a mobile banking app for check deposit yet?

Signing up for direct deposit can save you time, but mobile check deposit comes in super handy if you receive a paper check, like a tax refund or stimulus check.

So, if you aren’t taking advantage of mobile check deposit yet, consider signing up. You’ll soon learn just how convenient it is!

Stimulus payments and Chime

If you are a Chime member, you will be able to find out more about the status of stimulus payments on this page. We will be adding more details as we receive information regarding processing and payment timing.

Please note that our member support agents do not have information on the status of Economic Impact Payments.

Updated Jan 11th, 2021

If you have not received a stimulus payment yet, you may be impacted by an IRS error.

The IRS recently announced that it will reissue payments for all those affected by Feb 1. Most members should receive payment via direct deposit, or in some cases, paper checks.

We will continue to make payments available as soon as they arrive and keep you updated.

We've got your back

We’re offering temporary access to $200 of spending power through SpotMe to a random selection of eligible Chime members before their stimulus payments arrive.

Direct deposit your stimulus with Chime›

No hidden fees¹. Grow your savings automatically. Fee-free overdraft for eligible members².

Check my payment status›

Get information from the IRS on the status of your Economic Imapct Payment

Chime Deposit Fee

We've got your back 💚

If you have questions regarding the stimulus payment and your Chime account, please check out our FAQ below.

If you’re eligible for an economic impact payment, but haven’t gotten it yet, it’s likely that the IRS will send you a paper check or debit card. This is expected to start soon and continue throughout the month of January.

If you received the previous stimulus payment as a direct deposit and haven’t received a second stimulus payment, the IRS likely routed your payment to tax preparer companies instead of your account. These payments were rejected and returned to the IRS. If you were impacted, you’ll either receive a paper check or a debit card from the IRS. If you do not receive your payment in any form, then you can claim the Recovery Rebate Credit on your 2020 tax return.

To check the status of your payment, go to IRS.gov/eip and use the Get My Payment tool.

For more information check out the IRS stimulus FAQs.

As with all direct deposits, Chime will make your money available the moment we can. Unfortunately, we have no way to track the status of your payment until it arrives in your account, but you may get your stimulus check early.

We’re offering temporary access to $200 of spending power through SpotMe to a random selection of eligible Chime members. The new SpotMe limit is temporary and limits will be adjusted to normal levels once stimulus payments are distributed.

Also, this increase cannot be combined with any offers or other bonuses. The maximum SpotMe limit is $200. Learn more here.

Is the increased SpotMe limit an advance, loan, and/or will this be in addition to what I receive with the government stimulus?

Chime Bank Direct Deposit Time

Your increased SpotMe limit is not an advance from Chime, a loan, or an addition to the government stimulus. It’s simply a step toward helping make the expected payment available to use as soon as possible.

What if someone offers to get me my stimulus payment sooner?

Protect yourself from scams. If someone is offering you a faster stimulus payment in exchange for money or information, they are a scammer. The IRS has noted a wave of new schemes involving Stimulus Payments. Most schemes involve attempts to collect your personal or financial information in order to receive your payment sooner, but other schemes may involve first sending you a bogus check and requiring that you call in with or mail in additional information.

Chime Deposit Account

If you are the target of a scam, you can report it to the IRS by emailing phishing@irs.gov. For more information, see the IRS’s Coronavirus scams page.